What strategies can stakers use to pick the right vaults for adding liquidity and inventory to maximise gains.

Choosing the best vault to provide staking

To stake, you require both the NFT and ETH to pair with it. Here are some ways you can find the right collection to choose.

NFTs you already own

Often the best vault for you to provide liquidity for will be an NFT collection that you already own NFTs in.

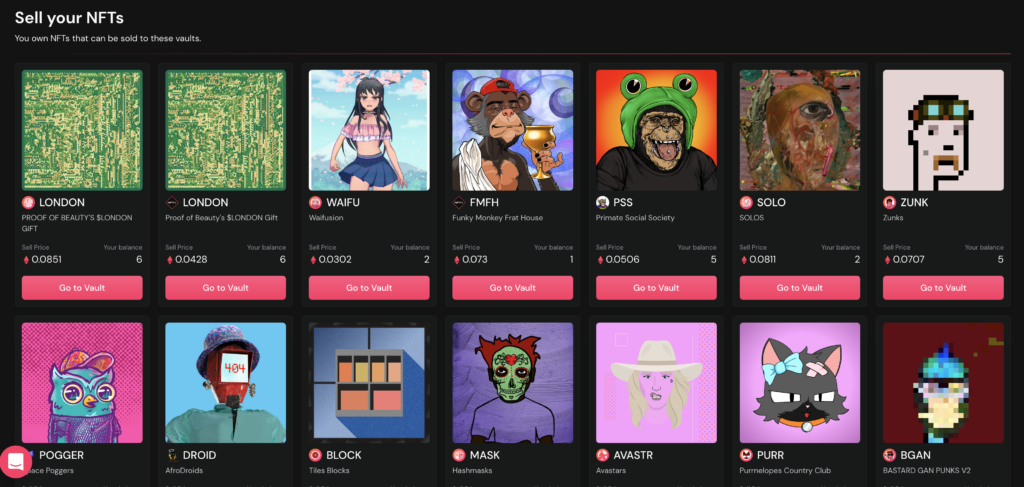

You can check which of the NFTX vaults you have NFTs for by going to the NFTX Sell page, but don’t worry you’re not selling anything just yet.

On the sell page you see an overview of all the NFTs you own that could be staked

Going to any of these vaults will allow you to choose which NFTs you want to mint and add to the liquidity pool, along with calculating how much ETH is required to pair with the current value of the Pool token.

Choosing the best APR returns

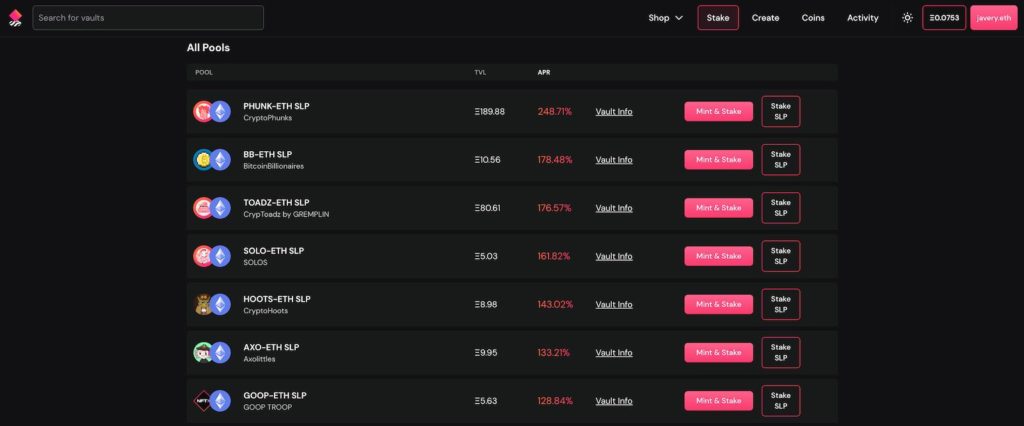

You can see how each of the NFTX Pools are performing on the NFT Staking page, and you can sort by APR to get an idea of the best value.

The APR is calculated by looking at the activity of the vault over the past 7 days and annualising that value. By picking a vault like CryptoPhunks or BitcoinBillionaires you will be getting the best APR returns based on the previous 7 days.

Choosing vaults you don’t own NFTs for

Just because you don’t own an NFT from a particular collection doesn’t mean that you are not able to joing the liquidity pool and stake your SLP to earn rewards.

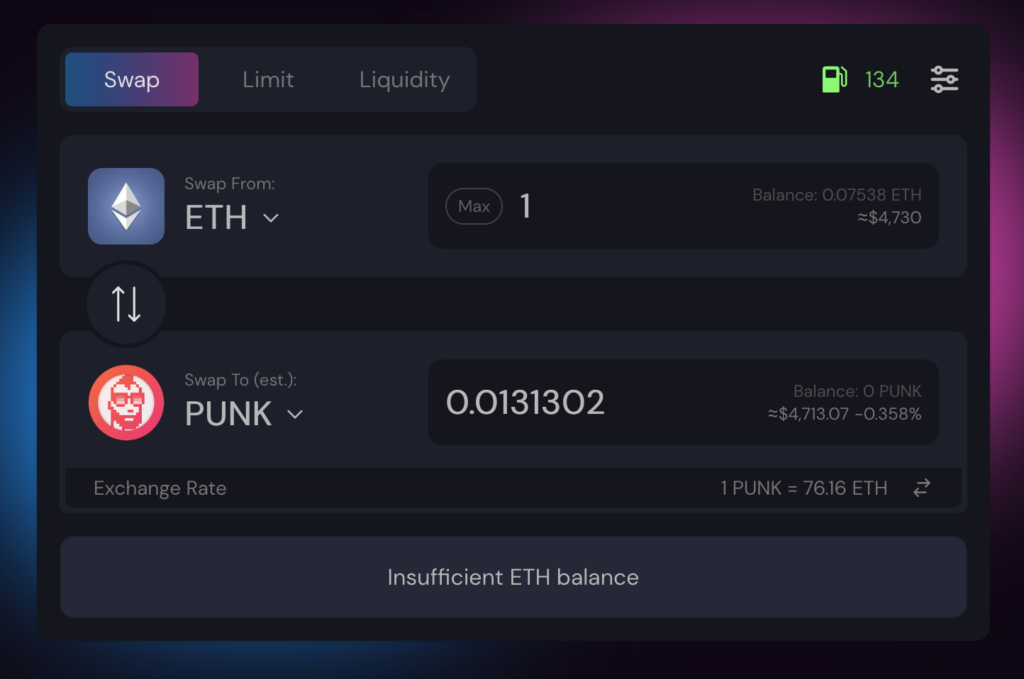

For vaults like PUNK, it is less likely that the average person will be able to drop their CryptoPunk into the vault for staking. Or, it may be the case that you own a non-floor CryptoPunk but still want to have exposure to the PUNK floor vault staking.

In these cases you can always buy a fraction of a punk and then stake that fraction against the equal amounts of ETH.

In the example below we are buying 1 ETH worth of PUNK through Sushi. Once purchased, we could then go to the liquidity tab and add that PUNK back to the pool and pair it with 1ETH, and then stake the SLP on NFTX to earn fees.

You should note, because of the way Liquidity Pools work when you buy 1ETH worth of PUNK you will need more than 1 ETH to provide liquidity, as buying tokens from the pool will increase the value of the token.

Let’s take a look at the requirements for Staking