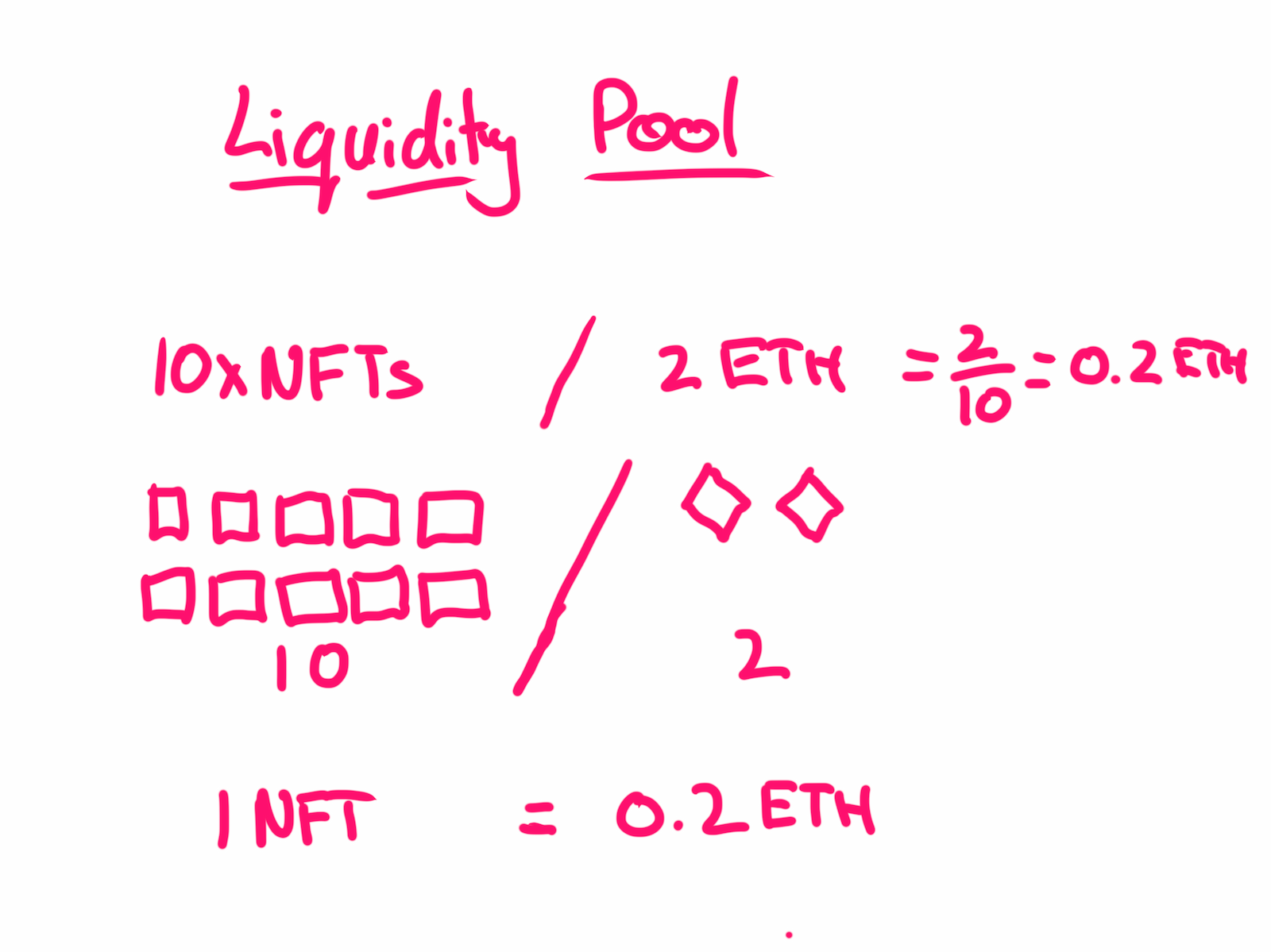

A liquidity pool has NFT vault tokens balanced with ETH. Let’s say there are 10 NFT tokens in the pool and 2ETH. This would make the price of the NFT on NFTX around 0.20ETH.

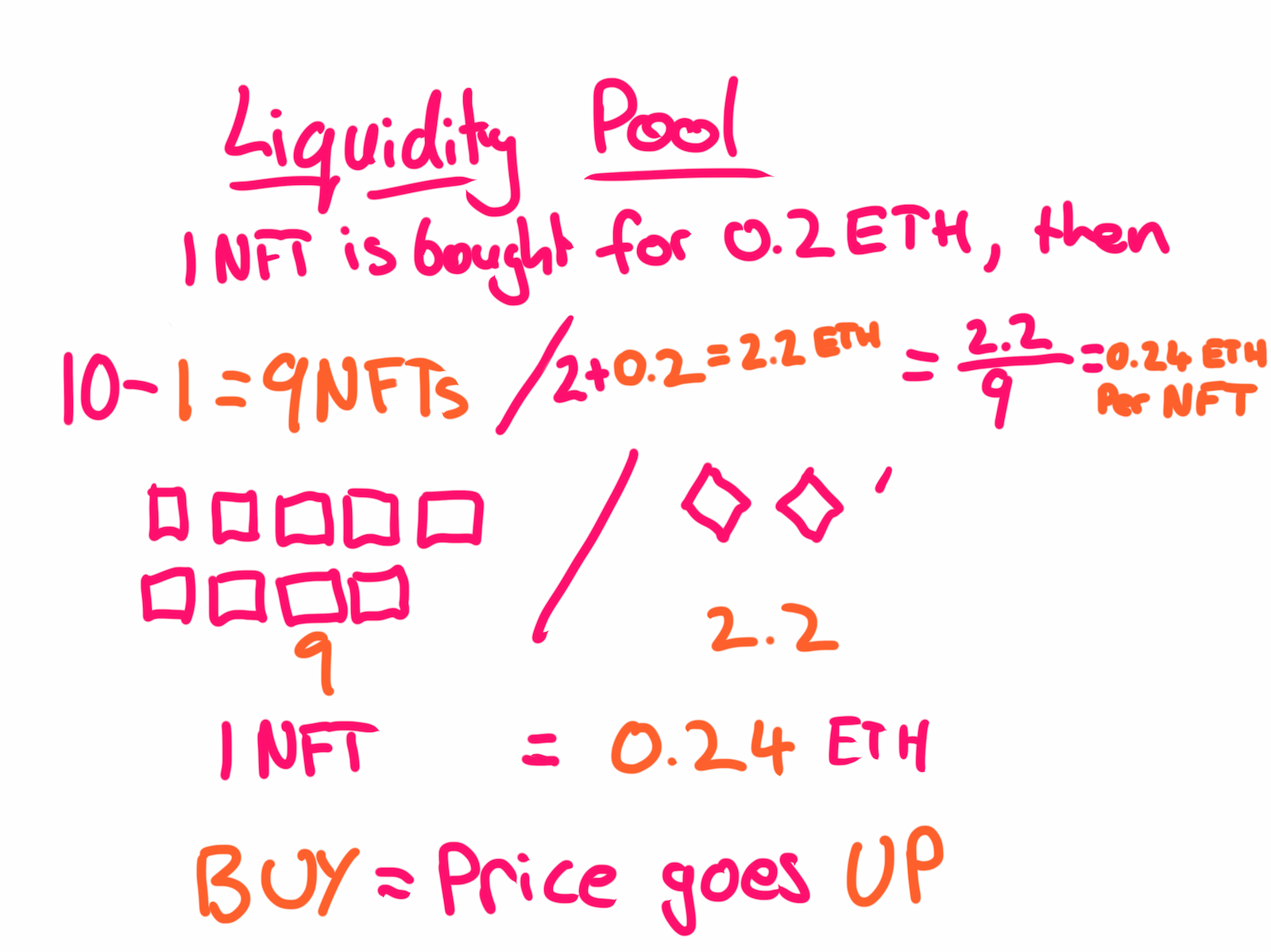

Now, if one NFT is purchased for 0.2 ETH then you remove one NFT from one side of the pool and add 0.2ETH onto the other side of the pool, resulting in 9 NFTs and 2.2ETH. This means the price for the token has gone up to 0.24ETH per NFT.

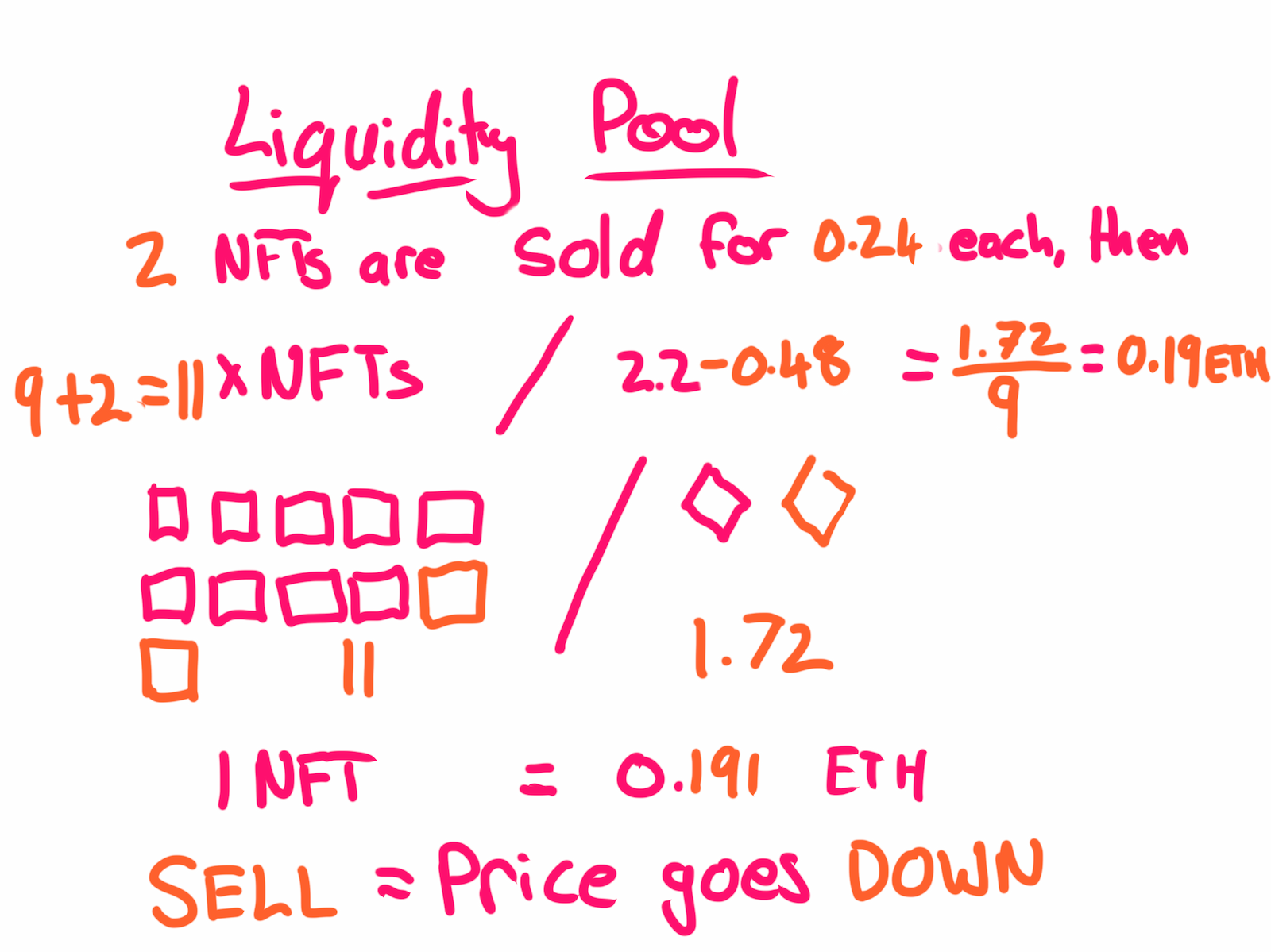

The same thing happens the other way around. If two NFTs are sold for 0.24eth then two NFTs go into the pool (now 11 items) and -0.48ETH is taken from the pool (now 1.72) making each NFT in the vault now worth 0.19ETH.

This is a simple example that ignores that buying NFTs requires 1.1 tokens with 0.1 tokens going to stakers as fees, but the principle is the same.

The deeper the pool, the less motion in the ocean

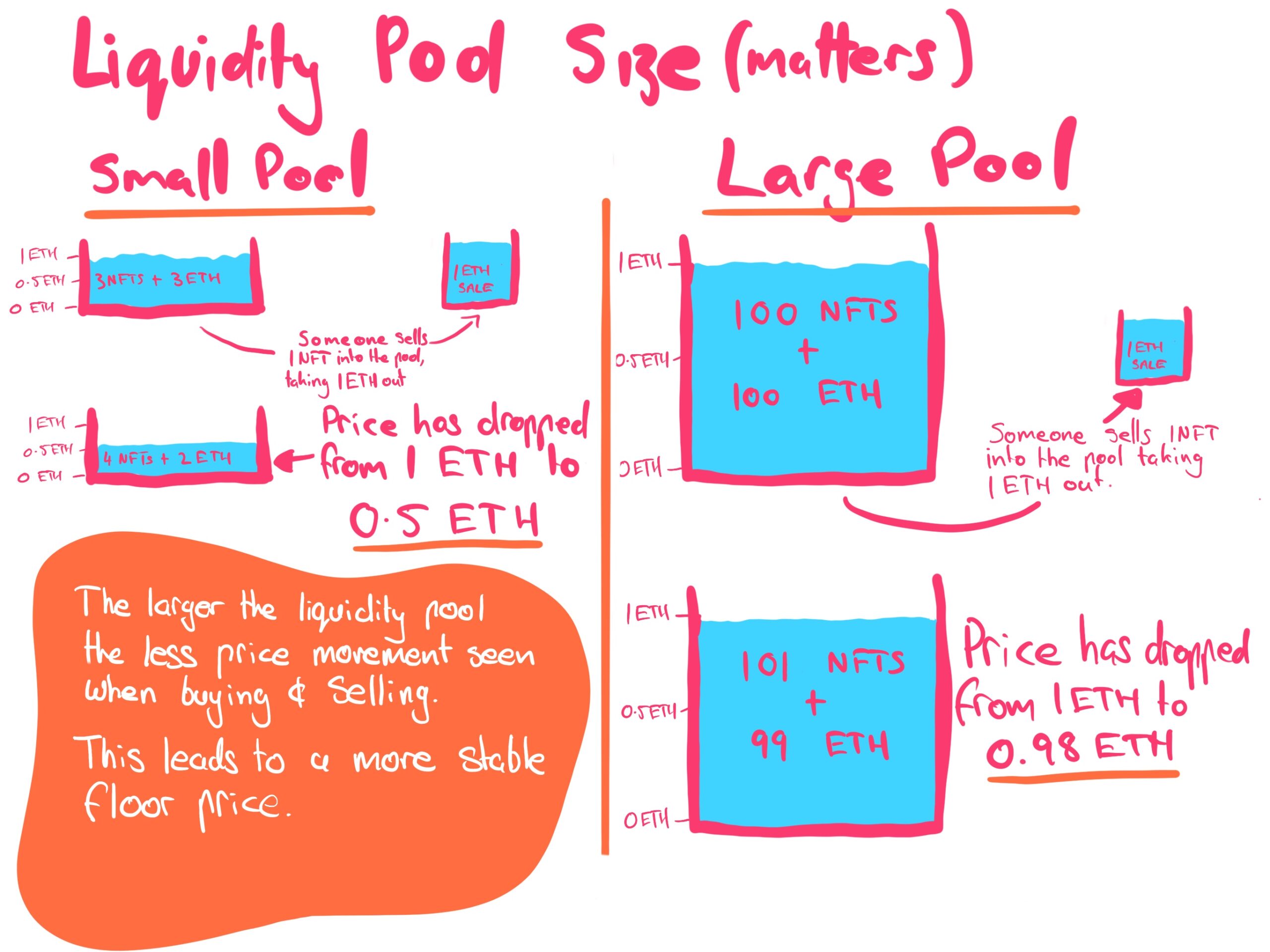

Now you have seen how liquidity pools work, let’s take a look a why it is important to get the largest liquidity pool you can to maintain a stable token price.

Let’s take two examples, a small pool where the liquidity pool has only 3 NFTs and is paired with 3 ETH, and a large pool where there are 100 NFTs paired with 100 ETH.

Both of these pools provide you with an NFT price of 1ETH

3NFTs /3ETH = 1ETH per NFT

100NFTs/100ETH = 1ETH per NFT

If someone sells an NFT into the small pool we end up with

- 4 NFTs in the pool (the person selling added their NFT to the pool)

- 2 ETH (the person selling took 1ETH out of the pool)

Now we’re left with 4 NFTs and 2 ETH, or 2ETH / 4NFTs = 0.5ETHper NFT

If someone sells an NFT into the large pool we end up with

- 101 NFTs in the pool (the person sold their NFT into the pool)

- 99 ETH (the person selling took 1ETH out of the pool)

Now we are left with 101 NFTs and 99ETH, or 99ETH/101NFTs = 0.98ETH per NFT

Buying NFTs from the pool works in the same way as our earlier example with 10 NFTs in the pool, but with a larger pool that price impact is greatly reduced.