The fees earned while staking are accrued per block as the buys/sells/swaps occur on the vaults. These fees are then distributed to the liquidity providers within the same block.

Liquidity provider staking reward distribution

The liquidity provider staking fees are paid out in vault tokens and can be claimed at any time from the staking page. Remember, it costs Gas to claim the tokens so make sure you’re not claiming less than it costs to claim. If you ever exit your position the unclaimed amount is automatically claimed and returned to you as part of the transaction.

You can get an idea of the fee rewards using the APR figure associated with each of the vaults. This is calculated using the past 7 days fees annualised and can be found on the Info tab on each vault (and listed on the Earn page).

Inventory provider staking reward distribution

The inventory provider staking fees are paid out in vault tokens and added to your current position so that you are auto compounding the fees you are earning.

You can get an idea of the fee rewards using the APR figure associated with each of the vaults. This is calculated using the past 7 days fees annualised and can be found on the Info tab on each vault (and listed on the Earn page).

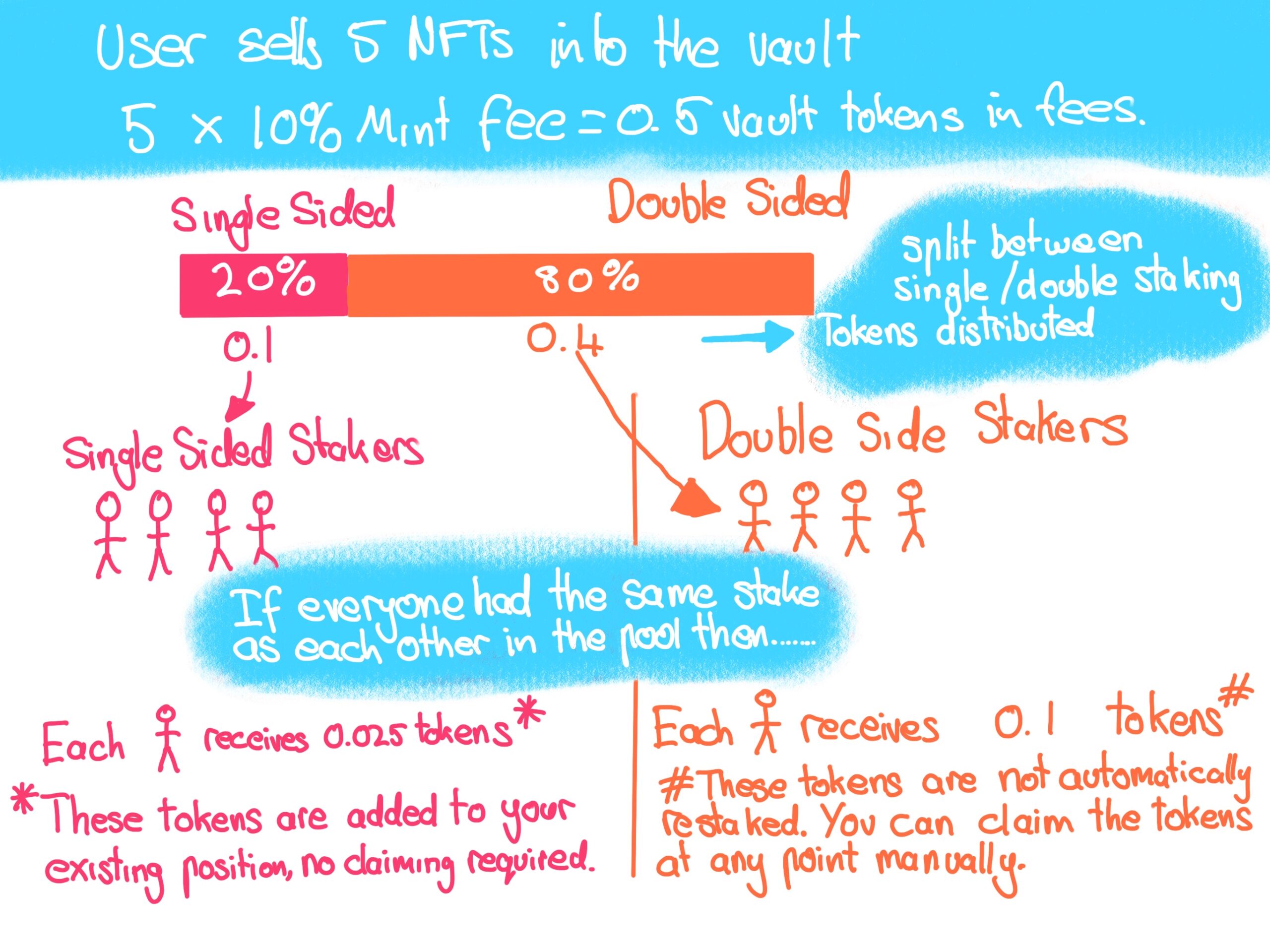

Let’s look at an example.

Reward distribution examples

Simple Example

A user sells 5 NFTs into the vault that has 10% mint fees. This transaction generates 0.5 vault fees which is then distributed to our stakers.

The split between double sided and single sided is 80/20, so from the 0.5 vault fees you have 0.4 going to the double sided staked users, and 0.1 going to the single sided staked users.

Let’s say that in the single sided staking pool there are four users who each have staked one NFT each. This means that they have an equal share of the single sided pool and receive $0.1/4 = 0.025$ tokens each.

In the double sided staking pool we’ll assume there are eight users who have staked 1 NFT and the equivalent amount of ETH. This also means they have an equal share of the liquidity pool and receive $0.4 / 8 = 0.05$ tokens.

Complicated Example

Let’s go with a similar scenario, except this time the different staking pools look like this

| User | Inventory Provider | Liquidity Provider |

|---|---|---|

| Simon | 2 | – |

| Sonia | 1 | – |

| Debbie | 5 | |

| Darin | 10 | |

| Darlene | 2 | |

| Total | 3 | 17 |

The total number of NFTs staked inside the vault is 3 + 17 =20

Inventory Provider

- Simon with 2 NFTs

- Sonia with 1 NFT

Liquidity Provider

- Debbie with 5 NFTs + ETH

- Darin with 10 NFTs + ETH

- Darlene with 2NFTs + ETH

The same situation happens where 5 NFTs are sold into the vault which generates 0.5 vault fees which is distributed to our five staked users.

20% of the fees goes to inventory providers and 80% of the fees go to liquidity providers, 0.1 and 0.4 respectively.

The inventory pool has 3 items, so that’s

0.1 / 3 = 0.033333 per token

And then we have our inventory provider stakers

- Simon receives 2*0.033333 = 0.066666 tokens

- Sonia receives 1*0.033333 = 0.033333 tokens

The liquidity provider pool has 17 items, so that’s

0.4/17=0.02352941176 per token

And then we have our liquidity provider stakers

- Debbie receives 5*0.02352941176=0.1176470588

- Darin receives 10*0.02352941176=0.2352941176

- Darlene receives 2*0.02352941176=0.04705882352

As you can see, even though Darlene is staking 2 NFTs plus ETH on the liquidity pool, Simon from inventory is earning more tokens with the same number of NFTs without also having to stake ETH. This is because of the size of respective pools, and in that instance even though single sided only gets 20% of the fees, the pool is small so users receive more rewards.

It is expected that the inventory provider pools will be much larger due to the lack of impermanent risk so this situation is unlikely, but possible.

That’s all there is to know about Staking on NFTX. If you have any further questions please ask them on the help section on https://nftx.io in the bottom right corner, or ask on https://discord.gg/nftx-779073151115984926.

Next you can learn more about NFT Projects or Shopping on NFTX, or you can check out some Staking tutorials below